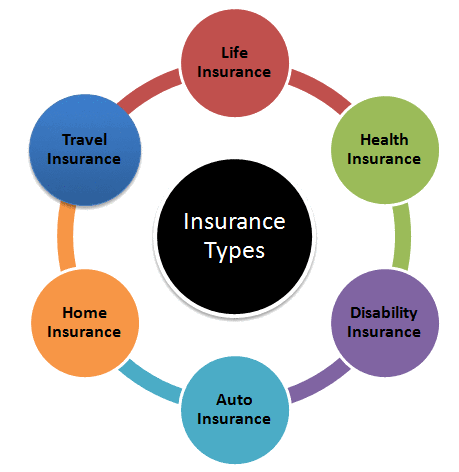

Choosing The Right Insurance For You: Major Types

Choosing The Right Insurance For You: With so many possibilities, it can be difficult to determine which life insurance policy or business is ideal for your needs. To assist, here is an explanation of the many types, how they function, and when each is typically a suitable fit.

There are two types of life insurance plans: term and permanent. Term life insurance provides coverage for a set length of time, but permanent life insurance might last the remainder of your life. However, the alternatives do not end there. Many additional types of permanent life insurance meet various needs and preferences. There are other options available, including whole life, universal life, variable life, and more.

Choosing The Right Insurance For You: Major Types

Health Insurance

Health insurance policies help cover medical and healthcare expenses in case of illness or injury. The two major types are private health insurance and government-sponsored insurance. Private health insurance is provided by employers or purchased individually from a health insurance company. Government health insurance includes Medicare, Medicaid, and the Children’s Health Insurance Program (CHIP). These government programs provide health insurance coverage for senior citizens, low-income individuals, children, and people with certain disabilities.

Life Insurance

Life insurance provides financial protection for your loved ones if you pass away. The two main types are term life insurance and permanent life insurance. Term life insurance only provides coverage for a specific period of time, while permanent life insurance provides coverage for your entire life. Permanent life insurance, such as whole life, universal life, and variable life insurance, also typically allows you to accumulate cash value that you can borrow against.

Auto Insurance

Auto insurance helps cover costs resulting from incidents involving your vehicle. The major types are liability coverage, collision coverage, comprehensive coverage, medical coverage, and uninsured motorist coverage. Liability coverage helps pay for damages to other people and their property. Collision coverage helps pay for damages to your vehicle. Comprehensive coverage helps pay for damages to your vehicle from events other than collisions such as fire, theft, or vandalism. Medical coverage helps pay for medical bills resulting from an accident. Uninsured motorist coverage helps pay for damages caused by uninsured motorists.

To summarise, the three major types of insurance policies are health insurance, life insurance, and auto insurance. These help provide financial protection against risks that could lead to significant medical, repair, and other costs. Choosing the right types and amounts of coverage based on your needs and situation is important to gain peace of mind and protect your financial well-being.

Read also: Nursing Positions in Canada With Visa Sponsorship for Immigrants

Choosing the Right Insurance Coverage

Health Insurance

Health insurance coverage provides financial protection in the event of medical expenses due to illness or injury. There are several types of health insurance plans to choose from, including health maintenance organizations (HMOs), preferred provider organizations (PPOs), and high-deductible health plans (HDHPs) paired with health savings accounts (HSAs). Evaluate the out-of-pocket costs, network of doctors and hospitals, and coverage of each plan to determine what options meet your needs and budget.

Homeowners Insurance

If you own a home, you need homeowners insurance to protect your investment. Homeowners insurance covers the cost of damage or loss to your home and belongings due to events like fire, theft, or natural disasters. The coverage amount should be sufficient to rebuild your home and replace its contents. Additional riders can be purchased for high-value items like jewelry or artwork. Consider the likelihood of risks in your area like floods or wildfires that may require additional coverage.

Auto Insurance

Auto insurance is required in nearly every state and provides coverage in the event of an accident or vehicle damage. Liability coverage pays for injuries or damage to another driver’s vehicle in an accident you cause. Collision coverage pays for damage to your own vehicle. Comprehensive coverage pays for damage due to events other than a collision like vandalism or a natural disaster. Uninsured/underinsured motorist coverage protects you in the event an at-fault driver has insufficient or no insurance. Choose coverage amounts that meet your state’s minimum requirements and protect your assets.

In summary, review all available insurance options to determine what coverage and amounts are appropriate for your needs. Work with an insurance agent to obtain quotes and understand the specifics of different policies. Making well-informed choices about insurance coverage can provide you peace of mind and financial security.

FAQs

What are the major types of insurance?

The most common types of insurance are:

- Health insurance: Covers medical expenses for illness or injury. Medical insurance is required to have health insurance coverage in many countries.

- Auto insurance: Covers costs associated with vehicle accidents or damage. Liability insurance is required to legally drive a vehicle.

- Homeowners insurance: Covers losses and damages to your home, property, and belongings. Also includes liability coverage. Required by most mortgage lenders.

- Life insurance: Provides financial protection for your loved ones if you pass away. Term life insurance provides coverage for a specific time period, while whole life insurance also builds cash value.

- Property insurance: Covers losses and damages to your business property and equipment. Required for most commercial property owners and business loans.

How does insurance work?

Insurance works by pooling risk. Individuals pay premiums into a fund, and the insurance company uses that fund to pay for claims. Not everyone will experience loss or damages, so the premiums of those who do not file claims help offset the costs of those who do. Insurance allows individuals and businesses to transfer risk to the insurance company in exchange for monthly or annual premium payments.

What factors determine insurance premiums?

Several factors are used to calculate your insurance premiums:

- Coverage and limits: The more coverage and higher limits you choose, the higher the premium.

- Deductibles: Higher deductibles (the amount you pay out-of-pocket) mean lower premiums.

- Location: Insurance rates vary in different locations based on risks like crime rates, natural disasters, cost of living, etc.

- Age, health, and lifestyle: For health and life insurance, your age, health conditions, occupation, hobbies, smoking, and other lifestyle factors affect your premiums.

- Value of property: For home, auto, and property insurance, the replacement value of your property, vehicles, and equipment is used to determine premium rates.

- Claims history: If you frequently file insurance claims, especially for suspicious losses, your premiums are likely to increase. Insurance companies view you as a higher risk.

- Type of coverage: Different types of coverage like liability-only auto insurance or comprehensive health insurance have different premium rates.

In summary, the major factors that determine how much you pay for insurance coverage are the level of risk, value of what’s being insured, location, and personal attributes. The more risk involved and the more coverage you need, the higher your insurance premiums.

Read also: 7 Best Student Loan Refinance Companies of 2024